Auctions for luxury residential properties around Boston are rare, to say the least. On occasion, we see one-off condos or brownstone buildings where an owner has run into financial difficulties and has been delinquent paying back the bank. In these cases, the bank may run the most common type of real estate auction, a foreclosure process. There are different types of foreclosures in different states but that is not our main topic here.

Foreclosure Auctions

Assuming a lender can’t reach an agreement with a delinquent homeowner, the aim of the foreclosure process is to offload a property to a new owner so the bank does not have to keep the property on its balance sheet. More poignantly, banks have zero interest in the property management business and owning properties means managing them. Auctions have proven to be the most rapid way to “unload” properties that are unwanted by existing owners. Typically the banks will have given owners ample opportunity to catch up on their payments but when all else fails, the auction process plays out. Naturally, we see more of these in difficult economic times than in “boom” times like it was in downtown Boston for close to 12 years (2010-2022, ‘ish).

Real estate auctions (and foreclosures) can come to the commercial sector as well and those may be tied to large commercial debt packages where a developer is unable to live up to the underwriting that they set out to achieve (i.e. the market did not support their anticipated unit by unit pricing).

Non-Foreclosure Real Estate Sales Auctions

In 2009, we saw a real estate sales auction on a luxury condominium development for possibly the first time in Boston. This happened at 303 Columbus Avenue, aka The Bryant. These auctions are different from a bank auction. A sales auction is a marketing tactic used by developers and sales agencies to jumpstart closings at a building that has seen stagnant sales conditions. Developers tend to set a “minimum reserve price” that they are willing to accept on some percentage of the units that are left available in the building. The reserve price will usually be at least 10-20 percent lower than the price that units have been marketed for in the past. The hope is that the auction generates multiple bidders and units might come back up toward the originally expected sales value. However, it’s not uncommon for the units to sell at the minimum reserve amount (or not at all) which gives the developer a more clear indication of today’s true market value for the project.

The St. Regis Bid Sale

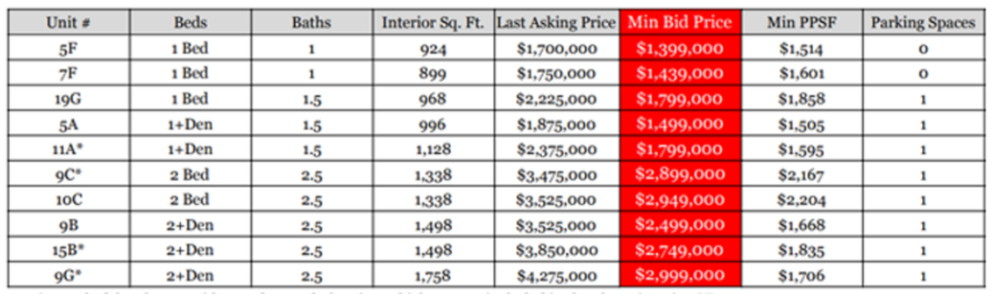

Starting on October 25th 2023, the Boston St. Regis sales team conducted a bid sale event featuring 10 one and two- bedroom residences. Bid submissions were due on November 16th. Minimum bid pricing was set as much as 30 percent below previously announced asking prices!

We’re monitoring the process closely as none of the units closed by the 2023 year end deadline. The in-house sales team states that bid pricing will not continue for remaining units after this set of 10 closes, as the hope is this auction will rekindle some interest in the units.

We know this product very well and are happy to introduce buyers to opportunities in the building that will look like great investments over the course of time. Please get in touch to learn more about specific unit stacks and sight lines in the building.