Across the nation, articles bemoan the lack of real estate inventory. While typically we encourage our Boston luxury real estate clients to de-emphasize, or even disregard, national housing headlines, this year the themes locally and nationally align: a very limited number of homes available for sale along with pricing that continues to push higher in the face of what might otherwise be headwinds (i.e. rising interest rates, global unrest and economic uncertainty).

As we enter our busiest season of the year (March through early June), we do expect to see increasing inventory across the Boston high end market. However, modest increases over a complete dearth of availability, sadly, won’t provide buyers with a great sense of relief.

Anecdotally, our experience in the fall of 2021 was that there were many luxury buyers starting to scan the city markets for a housing purchase. Most of these buyers seemed content to educate themselves in the fall with the sense that they’d move forward on purchases in the more robust spring market… in part thinking that Covid concerns would not continue to linger in the new year. As the year turned over and the Federal Reserve began to speak more specifically about rising interest rates, many buyers jumped at the chance to lock in potentially lower mortgage costs in the first 30-45 days of the year. Almost all units that were available in January and February were spoken for in short order.

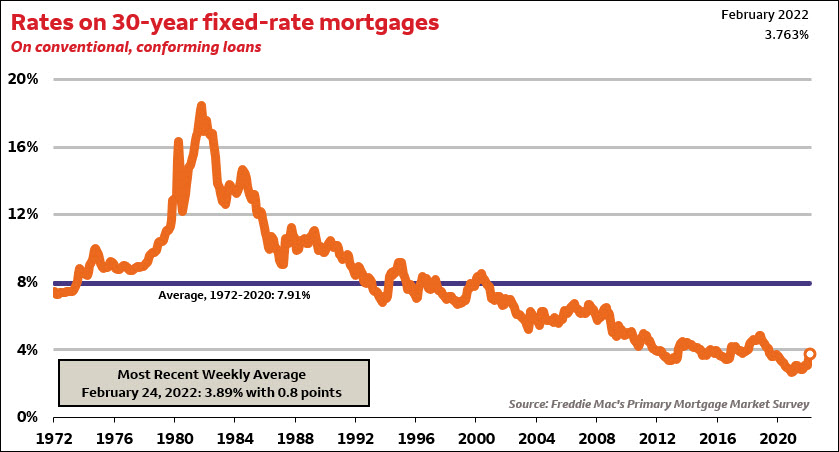

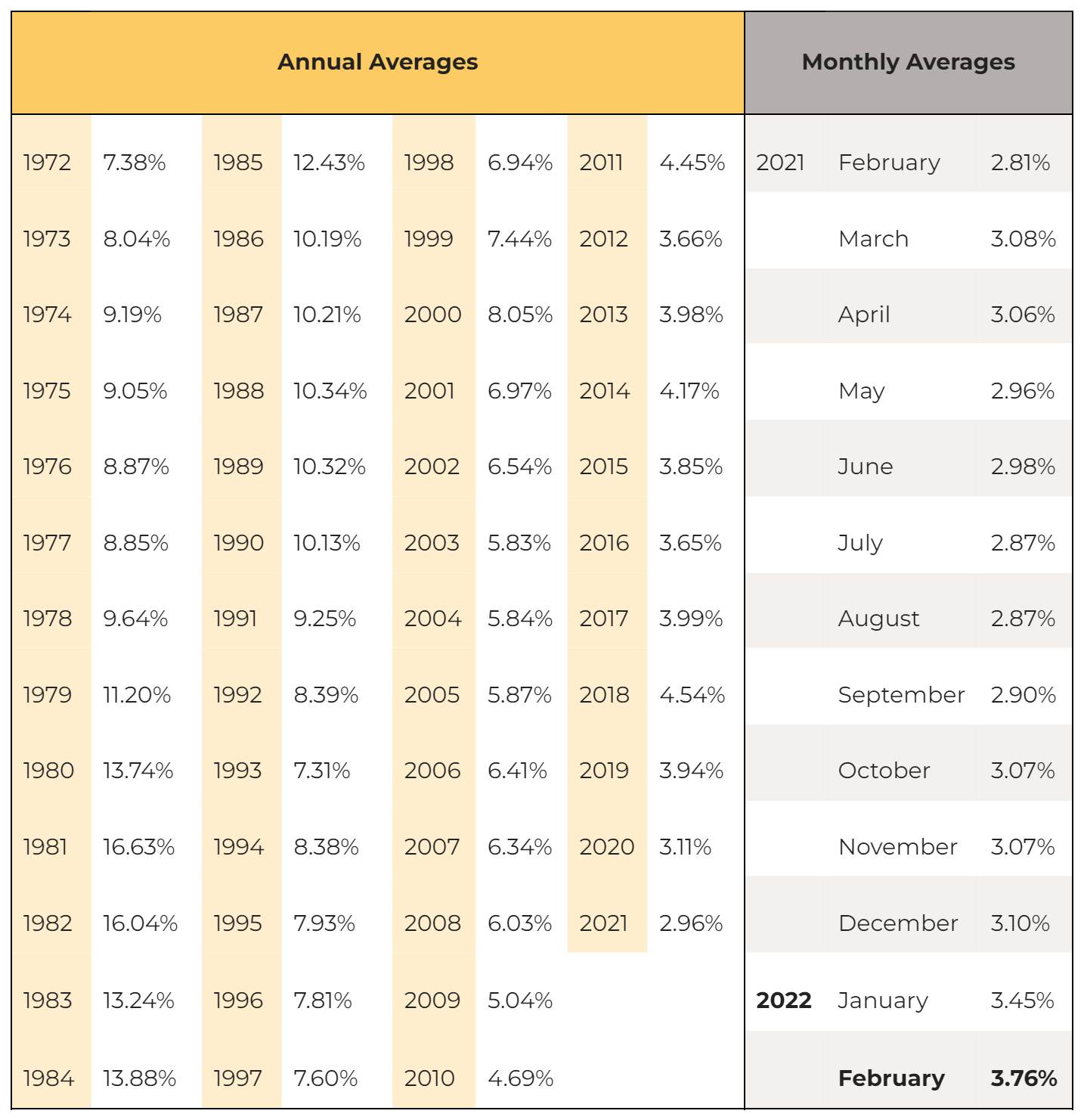

As we enter March, interest rates are materially higher than they were 60 days ago let alone 12 months ago. February 2021 featured rates that were sub 3% for a 30 year fixed rate mortgage. In January of 2022 the rate had risen to 3.45% and subsequently 3.76% for February. For more detail, see chart below from Michael Vautour, a Home Mortgage Consultant at Wells Fargo.

Fair warning on another national headline but Zillow expects housing prices to rise by another 17 to 21 percent in 2022!! Without trying to sound the alarms, how is this possible? We’re talking about a unit that was worth $2M at the end of 2021 increasing to $2.4M in early 2023? Stop it!

To the point, we’re already seeing examples of condos that traded less than two years ago in the city coming online for 10-20 percent more than what they sold for previously. In November 2021, unit 4 at 156 Worcester Street sold for $1.18M. Fast forward to March of 2022 and that condo is being shopped off-market for $1.4M with whispers that it will trade above asking price. Nuts!

The opinions of value we’re submitting to listing clients in early 2022 have the largest ranges we’ve offered in years. In previous years we’ve offered pricing ranges of 5% when quoting strategic listing prices three months into the future. For example, a listing that we thought would be close to $2M might have a value range of $1.95M to $2.05M. Now, that range is at least doubled ($1.9M to $2.1M). It’s impossible to predict how buyers will react in this market as they continue to obliterate asking prices. In all seriousness, there’s a strategy to behold that eschews listing prices all together. Why bother putting a possible limiting factor for buyers to consider in the equation? List for $1 and let buyers bid as high as their heart’s desire.

If you’re one of the folks who is considering a geo-arbitrage play this year (abandoning the crazy Boston real estate market and moving to a place with more reasonable housing prices), I’d only half jokingly encourage you to test our $1 listing strategy. It’s very unlikely to slow you down on your way out of town.

Have a great spring in the wake of Covid 19. The city is back!

Don’t forget to look back on our 2022 Boston Luxury Real Estate Review for lots more details and stats on the luxury market.