As our typically frenzied spring real estate market has played out this year, the solidifying theme centers around an obvious shortage of deal making (and, of course, the ongoing supply side constraints we’ve faced for years).

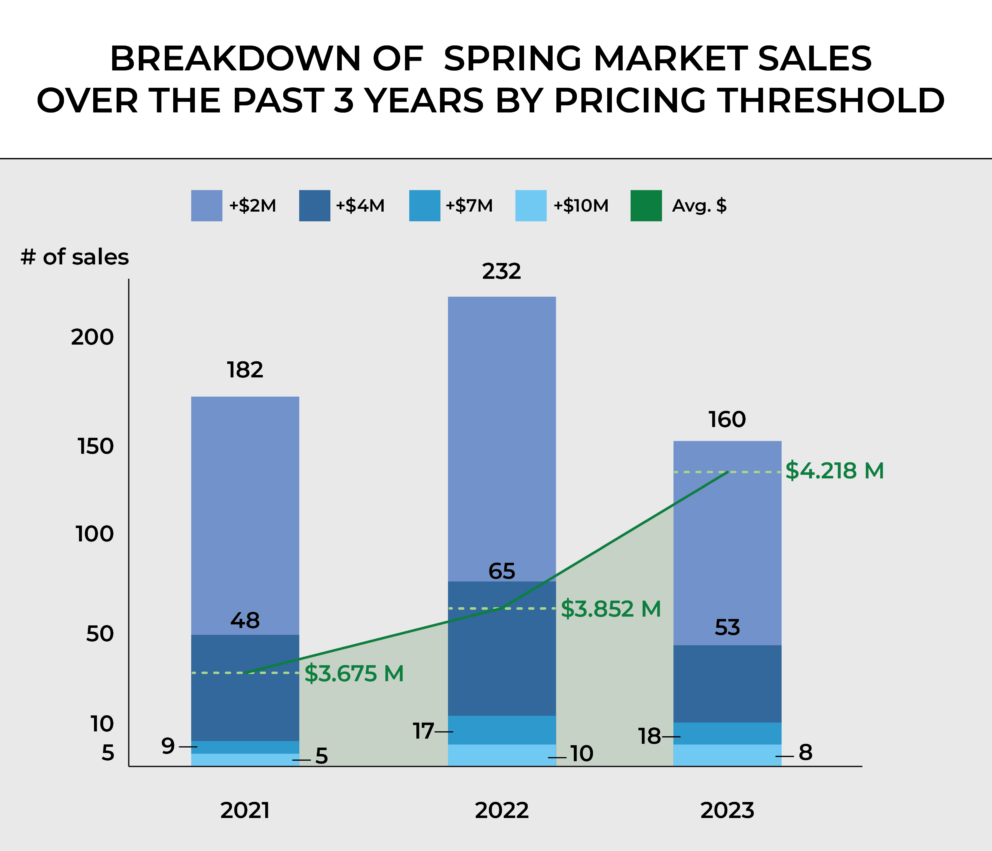

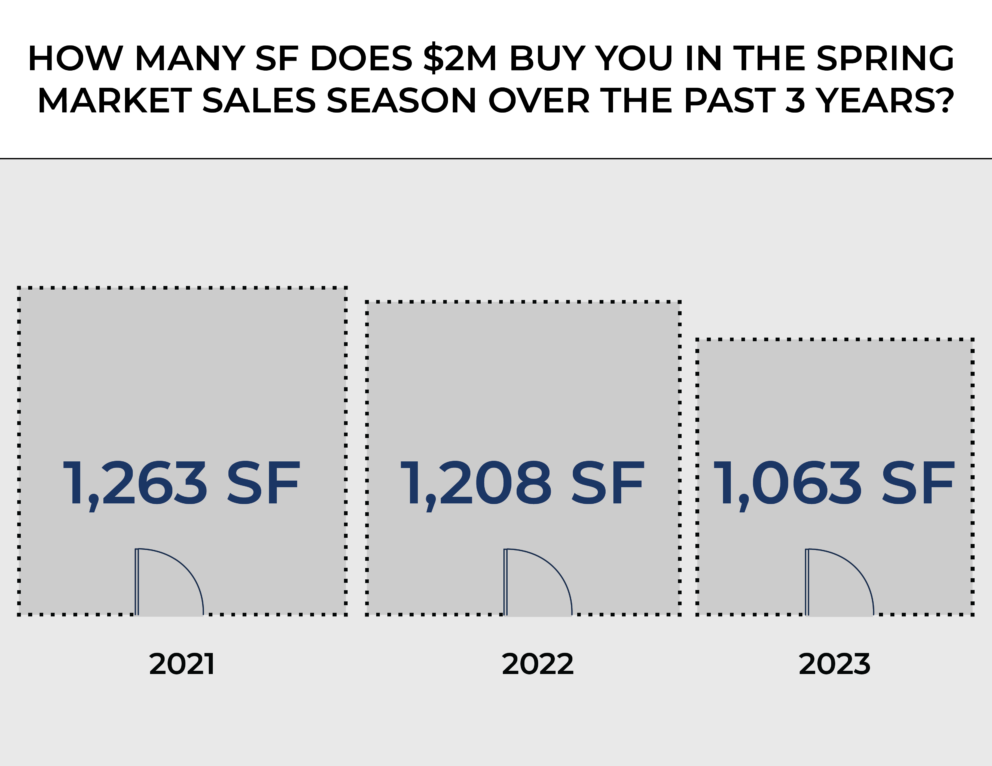

To date in 2023, the numbers in the luxury market ($2M+) in Boston are backing up our experience on the “street.” The Boston market is mostly mirroring national economic trends (not to be confused with national housing trends): demand continues to outpace supply, meaning we can’t really get a grasp on property appreciation (a proxy for inflation in this case). What we’re seeing are city home prices that are nearly 15 percent higher than a year ago while the number of transactions completed is 30 percent lower than in 2022! The ultimate difficulty is that, minus the most exceptional properties, prices don’t appear to be up and yet the broad statistics tell us that they are. The haves and have nots, even within the luxury market, are as far apart as ever.

Source via MLS PIN and LINK Boston

There’s no doubt that cash buyers have been on the rise this year as those who’ve been hoarding cash are less inclined to pay mortgage rates in the high 5’s or even 6’s. Whereas historically we’ve seen around 15-25 percent of our deals end up as truly all cash, this past quarter has been closing in on 50 percent cash deals.

It is a bit perplexing where we go from here. Boston will never materially add to its brownstone housing supply (think: the brick row houses in Back Bay, Beacon Hill and South End). The quintessential Boston experience cannot be replicated and we don’t see a wane in consumers’ desire to achieve this lifestyle.

The other side of the coin features the ever increasing supply of high-rise product that has, at minimum, gained a nice foothold in Boston. Still, we’re not New York City… and we’re definitely not Shanghai where these buildings litter the landscape. Most buyers here continue to prefer the brownstone experience, leaving the supply side of the full service market much more robust than that of its historic, Victorian-era counterpart.

We see many consumers who are locked into incredibly low priced mortgages that would like to move but have trouble giving up the now “discounted” housing costs they achieved between 2017 and 2022 (whether via purchase or refinance).

On the other side, there are renters who are exhausted paying exorbitant rents that would, similarly, be happy to purchase but struggle to accept less than “perfect” when they know their home ownership costs will be even greater than their high rents when it’s all said and done (interest, taxes, condo fees). On top of all that, census level statistics are suggesting that we are losing population in Greater Boston as people opt for lesser priced regions (and, likely, better weather).

We continue to work with buyers who expect things are going to change (for the worse) in Boston… short of the next black swan swooping in this summer, we just don’t see it. We’re witnessing a modest uptick in demand from Asian (Chinese) buyers who are coming out of their own post covid world with cash to spend on US real estate. The suburban empty nester continues to be far and away the most active luxury shopper in the city and the bounty of new bars and restaurants opening this year is a siren to young and old that the city wants you to be part of it.

At the risk of confusing you, there are deals to be had if you’re willing to look hard (and compromise on some aspects)… While the heights of city pricing continue to achieve new found stratospheres, there are also homes that can barely keep up with 2017 pricing in certain pockets of the city (corners of the South End and Beacon Hill, mostly). As we alluded to in some of our year end analysis in 2022, we do continue to see deals that trade for less than what they previously sold for in 2018-2021. We saw virtually none of that in earlier years when every time the same home traded it went up in price.

So, how do we conclude other than to say we think it’s more important than ever to have someone on your side who has experience across this eclectic and divergent market? Someone who knows when to poke and prod at dying deals and when to offer aggressively for the best product that will always maintain its advantages. Someone who knows how to price your asset to move when you need to move it and someone who knows how to capture the market’s attention when you have the cream of the crop.

Please follow along for our adventures and insights on social media. You can find us on all platforms @columbusasndover.