There was a time, not long ago, when the Boston luxury real estate market appeared to be taking a turn for the worse. The fall of 2018 and early winter

featured a stock market that was tumbling and an interest rate environment that was rising. That combination is, more often than not, deadly for residential

real estate markets.

Now that 2018 is fading in the rearview mirror, we can look back at the data to see that the end of the year was the rare blip on our real estate radar.

Typically, we look at the most recent two months of closed sales in order to glean how market activity from 90-120 days ago played out in the sales

data. While we have our empirical evidence and anecdotal observations, the only way to reveal authentic trends is via crunching large swaths of data.

BID VS. ASK SPREAD

The average days on market and average days to offer over the winter months stayed relatively even from 2018 to 2019 in the core downtown brownstone

markets. One of the biggest observed changes in the winter market data is the gap between the bid to asking price spread. Whereas in winter of

2017/2018, listings achieved 97.5% of their asking price on average, the winter of 2018/2019 saw that figure dip to 93.6%. This shows us that sellers

had increased their expectations while buyers appetite for consumption remained steady. During these more difficult months, sellers were pushed

to reconcile their expectations with the reality that buyers were not as voracious in light of some of those market forces mentioned above (equities

market and interest rates). Ultimately, the closed sale transactions of this year were negligibly higher than the previous year ($1,158/SF versus

$1,156/SF).

BY THE NUMBERS

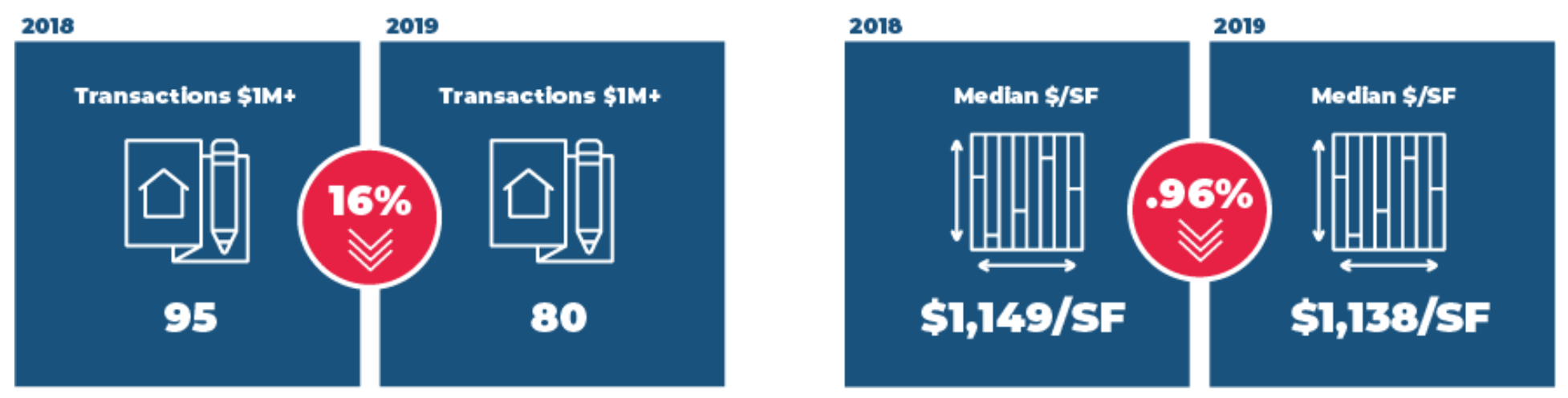

Through the first 2.5 months of 2019, there were 80 transactions over $1M in the Back Bay, Beacon Hill and South End combined. Compared to the same period in 2018, there were

95 transactions in these areas. That’s nearly a 16 percent decline in transaction activity. While the average price point was trivially higher

in 2019 than 2018, one mega transaction at Heritage on the Garden ($20M,

$4,000+/SF) single handedly made the year over year increase possible. Indeed, the median transaction price for this time period was higher in

2018 than 2019: $1,149/SF versus $1,138/SF, respectively.

Back Bay – Heritage on the Garden #1005/1006 | Sold: $20,000,000 | 1/22/2019

Home last sold in 2015 for $15,400,000

BACK ON TRACK

Fast forward a quarter of the year and those doldrums have quickly become a distant memory and an interesting case study in the “timing is everything”

world in which we exist.

Spring in Boston is a classic oxymoron. Having said that, the consistency with which the “spring” real estate market manifests itself each April is

rather impressive. The spring of 2019 will mark nearly a decade of growth in our residential real estate asset class. As of mid March, there are

no signs that this market will reverse course despite the apparent “late innings” status of this larger economic bull run. Buyers are active, sellers

have lofty expectations and brokers, well, we need more inventory!!