Is it a good time to buy in Boston?

As we pass the midpoint of another year, the questions around market dynamics seem as pressing as ever. The momentum across markets points toward an economic recession while housing markets nationally have begun to see changes, corrections, taking hold. Here in Boston, the demand side has continued to transcend the impact of rising rates and eroding economic conditions keeping housing prices stable so far in 2022. At least for the last 20 years, Boston housing prices have, more or less, withstood the strongest economic headwinds that we’ve had to face!

TLDR: We think the city housing market is facing some tricky times over the balance of this year. Higher interest rates accompanied by increasing inventory will have buyers feeling less motivated (concern over increased monthly payments and/or the more “emotional” fear of overpaying). Meanwhile, sellers may wonder why their property won’t trade like their neighbors did (quickly and resoundingly) in the spring of 2022. Ultimately, we expect the intense seasonality of the Boston market to bail us out of a general sales malaise come March/April of 2023. Until then, hold on.

Boston housing market: post-covid

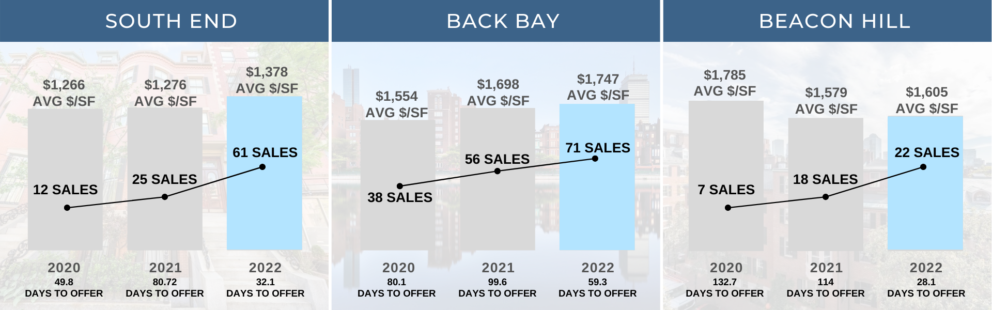

Following two full years of Covid and quarantine fever (no pun explicitly intended), we expected the city real estate market to surge in the spring of 2022. Boy did it! Starting early in the seasonal timeline that we follow so closely, we saw city real estate prices rocketing up from some of the pandemic level discounts that had been rather broadly available to intrepid buyers in mid to late 2020. You’ll see in the charts below both the transaction count and pricing growth in 2022 has been robust across the three core neighborhoods of Boston.

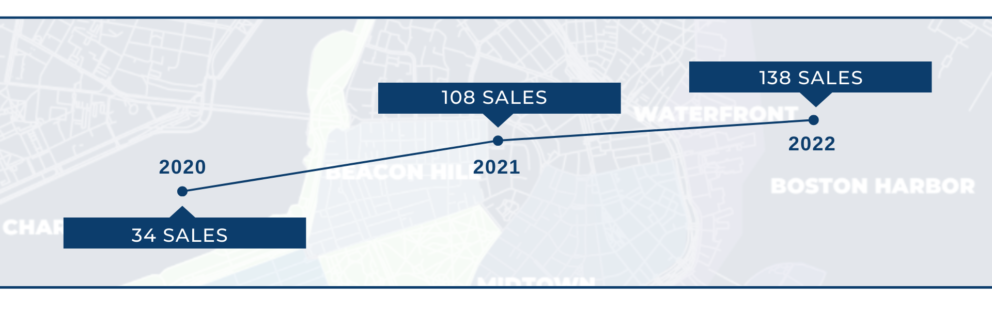

$2M+ CONDO SALES IN THE FIRST HALF OF THE YEAR

ACROSS THREE CORE NEIGHBORHOODS OF BOSTON

SE/BB/BH Combined over $2M (March through June)

2020: 34 sales | 2021: 108 sales | 2022: 138 sales

South End luxury housing market: Fall 2022 vs 2021

Here’s a list of the top 10 highest $/SF sales on brownstone style condos that traded for more than $1M in the South End in the first half of 2022:

- 108 Chandler Street, #3 – $1,576/SF

- $2.4M sale price on $2.2M asking price

- 517 Columbus Ave., #5 – $1,542/SF

- $1.2M sale price on $1.119M asking price

- 10 Claremont Park, #2 – $1,518/SF

- $2.847M sale price on $2.895M asking price

- 41 Rutland Square, #2 – $1,499/SF

- $3.255M sale price on a $3.250 asking price

- 27 Braddock Park, #2 – $1,490/SF

- $2.848M sale price on a $2.787M asking price

- 23 Upton Street, #2 – $1,483/SF

- $2.595M sale price on a $2.595M asking price

- 215 W. Canton Street, #1 – $1,454/SF

- $1.915M sale price on a $1.949M asking price

- 43 Union Park, #PH – $1,453/SF

- $2.85M sale price on a $2.995M asking price

- 209 W. Canton Street, #5 – $1,451/SF

- $1.045M sale price on a $939k asking price

- 82 Worcester Street, #3 – $1,443/SF

- $2.95M sale price on a $2.495M asking price

For context, 2021 featured four deals over $1,500/SF for the entire year in this category. There were six deals that closed for over $1,440/SF in all of 2021 whereas we’ve already had ten such deals in the first half of 2022. There are at least six more deals under agreement in the South End that will close for between $1,420 and $1,575/SF this calendar year and that ignores future supply that we don’t know about yet.

Changing times: Federal Funds, Interest rates and housing supply

More recently, conditions have shifted rather aggressively in the equity and bond markets and, even if it’s not fully jarring our housing market yet, those moves are bound to have ripple down effects across our sector as well. The May and June meetings of the Federal Reserve certainly added fuel to the fire of the economic hawks. The Federal Funds Rate target has increased from 0.0-0.25% in January 2022 all the way to 1.5-1.75% as of the most recent meeting in June. Threats of continued rate increases through 2022 are rampant. This is all intended to ease and reduce inflation back to the more modest 2% target that the Fed views as reasonable.

Over the last five years, the supply side statistics for luxury property around the city have been fairly consistent with the exception of a blip in 2020. Distinguishing between brownstone properties and full service properties is important as these numbers shift rather dramatically when you don’t differentiate. Please contact us to go into more depth here but looking at the current state of the supply side in our markets, it is interesting to note the following as of July 7, 2022:

We contextualize months of supply as such:

- Less than 4 months of supply: Seller’s market

- 4 to 6 months of supply: fairly balanced market

- More than 6 months of supply: Buyer’s market

MONTHS OF SUPPLY FOR UNITS OVER $1M

- 81 units for sale in the South End : 291 sold in last 12 months = 3.34 months of supply

- 85 units for sale in the Back Bay : 230 sold in last 12 months = 4.44 months of supply

- 27 units for sale in Beacon Hill : 82 sold in last 12 months = 3.95 months of supply

MONTHS OF SUPPLY FOR UNITS OVER $2M

- 29 units for sale in the South End : 99 sold in last 12 months = 3.5 months of supply

- 57 units for sale in the Back Bay : 130 sold in last 12 months = 5.26 months of supply

- 21 units for sale in Beacon Hill : 39 sold in last 12 months = 6.46 months of supply

Naturally, the intensity of a buyer or seller’s market increases as the months of supply go up and down, respectively.

Is it a good time to buy in Boston?

Overall, Beacon Hill and Back Bay continue to demonstrate greater supply than the ever tightening South End. Further, the South End numbers also include two larger buildings which have been selling out over the last two years: 100 Shawmut and 380 Harrison Ave. These units have not been trading quickly which is actually making the supply in the South End look larger than it is in reality. We find that the vast majority of South End buyers prefer the quintessential Victorian brownstone units rather than the newer luxury buildings that have popped up in the Ink Block area of the neighborhood.

As city residents think about buying or selling in the second half of 2022, it’s important to be as strategic as ever to avoid the traps of an evolving and transitioning market. We customize our approach and services to every single client and evolve with clients (and markets) as they move. Let us get to work on your behalf with our team of professionals who treat each client as a friend while maintaining the professional service relationship and integrity that you would expect from your most trusted advisor.