As we’ve all come to general terms with the new world we inhabit, the end of the third quarter of 2020 is a great time to look back at the year we’ve had in Boston luxury real estate. Before we look at the statistics and data that have been generated in these last 4 to 6 months, here’s what we prognosticated in our last update in May of 2020:

“Our professional opinion is that things may get harder for sellers as we move through the summer months and toward the end of the year. Although listing inventory remains razor thin in May of 2020, we believe there will be more listings that come to the market in the summer months (call it “pent up supply”). However, we have concerns that the stock market will struggle to hold its head up during the summer and, as such, buyers may lose some of their conviction to pay prices that sellers want and expect. In the meantime, landlords may be willing to concede additional offerings to their tenants in the form of rent reductions, short term extensions or even free rent to avoid any vacancy. Extending our prediction, we believe that listed properties (particularly at the higher end of the spectrum) that are even slightly “blemished” may sit throughout the summer. At that point, sellers may be forced to reconcile their bullish expectations and offer discounts on their properties in order to move on.

The sky is not falling. We’ve got plans to list a sizable chunk of inventory at different price points and in varying neighborhoods over the coming two months. We’re continuing to work with active buyers in the market and don’t believe there will be any drastic sell off in Boston. However, if we had to bet, Boston real estate prices will be lower in May of 2021 than they are in May of 2020. Keep in mind the run that we’ve had.”

So, while that blurb may not be precisely accurate as we type in mid October of 2020 (the stock market is up 10% – why were we making predictions about the stock market anyway?), it mostly holds true that “the going” has gotten tougher for sellers in Boston proper since May.

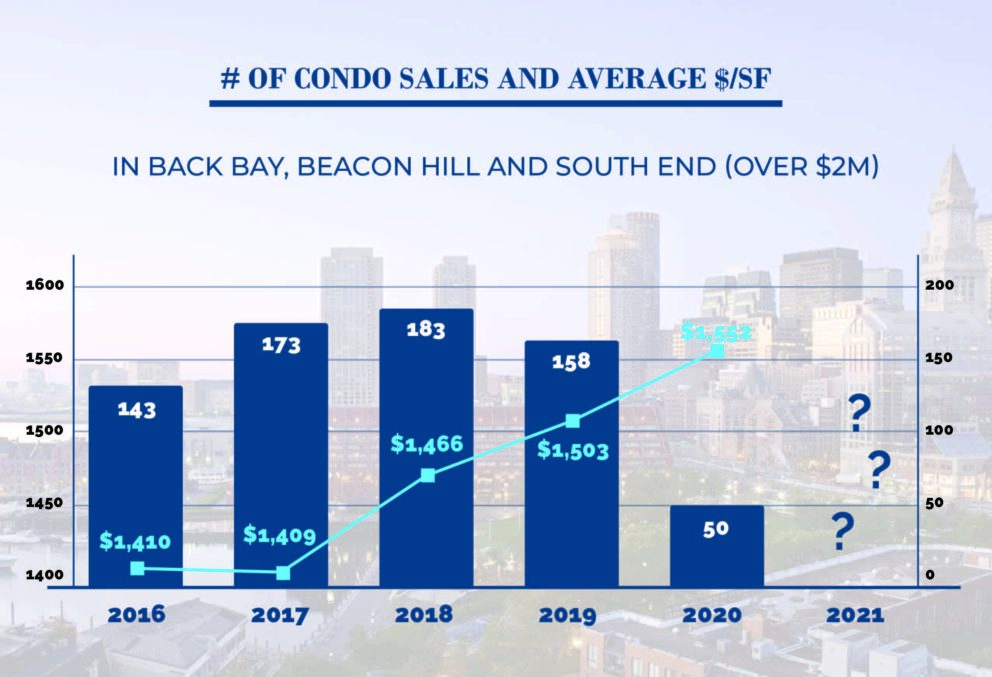

As of October 14, there are 206 listings in the Back Bay, South End and Beacon Hill that are priced over $2 million. In the preceding 12 months, dating back to October of 2019, there have been 158 sales in these neighborhoods above $2M. For those who know their real estate statistics, that equates to 15.7 months of supply. A balanced market (where neither a buyer nor a seller has a distinct advantage) is roughly 6 months of supply. It’s been a while but there is no doubt that it is OFFICIALLY a buyer’s market!

Looking at the luxury market ($2M+) specifically, there were 418 properties listed in Back Bay, Beacon Hill and South End during 2019. Of those, 216 (52%) sold during the same year (2019) that they were listed. In 2020, there have been 359 total listings in the category with 54 of those listings already sold and another 31 under agreement as of October 14. Effectively, that equates to 85 of the 359 listings being sold (24%).

In other words, if you listed a $2M+ property in 2020 you had a 24% chance of selling it within the year. Comparatively speaking, your chances of selling in 2020 were less than half as likely as 2019 when you had a 52% chance of a sale.

Lest anyone be mistaken, all was not lost in 2020. We’ve listed (and sold) 15 properties in the South End, Back Bay and Beacon Hill since Covid came into our lives in March. Further, we’ve represented 20 buyers as they’ve pursued more “appropriate” homes within the new world order. Prices on our deals have ranged from the $700k’s up to $7M.

So, what have we learned while doing business in the city during Covid?

- Location matters as much as ever… particularly in the South End where “Methadone Mile” has not improved in 2020.

- Another mantra: “turnkey” sells. If the home needed improvements, it is/was unlikely to move in 2020 without tremendous price discounting (i.e. 20% reduction versus 2019 value).

- Finally, sellers who were even remotely over zealous on pricing have been punished with stagnation. Those who showed sensitivity to the surrounding landscape have been rewarded with quick and efficient sales… sometimes even multiple offers.

In practice, our empirical data tells us that the best homes in the market were selling at a 2 to 5 percent discount in 2020 vs 2019 while the less favorable properties are selling at discounts north of 10 percent.

Like most people, we’re eager to turn the page on 2020. The next 90 days are likely to be long for those trying to sell property in the city. With the election (and all that it entails) only a few weeks away, Covid continuing to curse our communities and the holidays not far behind, it’s truly hard to imagine there’s going to be a run on luxury property in Boston before the New Year.

Conversely, if you’re an active buyer, this could be a truly historic time to strike. Odds are, the purchases in the end of 2020 and the beginning of 2021 will look great when we look back in a decade… Just like the purchases of 2010 to 2013 looked particularly brilliant 5 to 7 years later.

We’ll do a deeper dive on the numbers and data from 2020 at year end. No secret here, the Cliff’s Notes are going to show that pricing and most other variables in Boston’s core were negatively impacted by this year’s pandemic.