Like clockwork, July 4 brings hot weather and a serious slow down in our Boston luxury real estate market. In case you hadn’t noticed, this year (2020) is different… Not on the weather front but definitely on the real estate front! We’ve made it through the month of July and we’re continuing to work with active buyers and sellers across the market.

So, here’s the sales pitch for buyers: “Interest rates remain historically low. The stock market has (mostly) recovered. Sellers are more reasonable with their expectations. Inventory is being added and transaction volume is (relatively) high!” If we didn’t know any better, we might even be doing the same dance we’ve done for years. Price it low and wait for buyers to bid it up!

Truth is, we are currently navigating a tightrope maneuver with buyers and sellers alike. Every buyer feels like they deserve a deal while sellers continue to see properties go under agreement and wonder why their property isn’t one with the lucky “UAG” (under agreement) marker after a week on the market. Still, while the numbers continue to tell a positive(ish) story, the narrative within our real estate community feels a little flimsy.

Anyone living in the city will tell you that occupancy here is low. Residents in the higher end have mostly decamped for summer hangouts. Questions are myriad as we work through the summer and head towards fall. Biggest among them: what will the schools do? Additionally, most of the larger companies are pushing back office reopening until January (or never?)! In a city with such a high percentage of young people, the rental market is typically vibrant in the summer months even while the sales market is taking a break. This year, tenants find themselves in a more enviable position as the number of rental listings have surged to multi year highs.

There are currently 400 rentals available in the South End, 552 rentals available in the Back Bay, and 284 rentals available in Beacon Hill. In 2019, between June 1 and August 31, 264 units rented in the South End, 326 rented in Back Bay and 166rented in Beacon Hill. From the data taken from MLS, as of 7/30/20 there is a 4 month supply on the market in the South End, 5 ½ months of rental supply for Back Bay and 3 months of rental supply in Beacon Hill. With one month to go leading to Boston’s biggest move-in date we will expect to see some volatility.

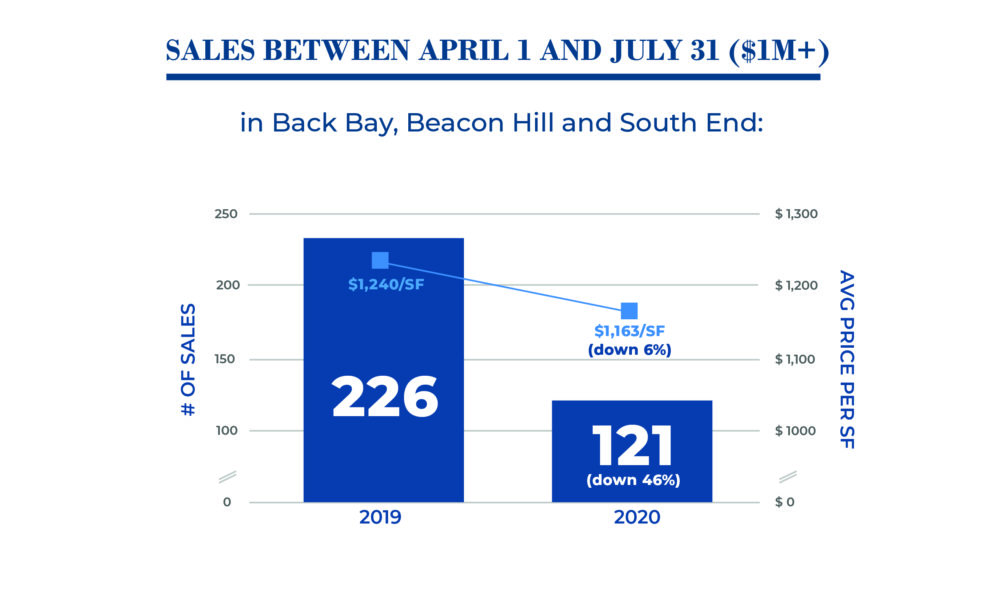

As for the sales numbers, the story is nuanced. Premier addresses and renovations continue to sell… and sell relatively well. Properties that lack the most prestigious addresses or need updating to kitchens or baths, are very likely to stagnate on the market and, ultimately, sell for discounts against what they would have achieved a year before.

It would appear that we are trending in the direction of a year in 2020 that could show “discounts” of 10+ percent for higher end properties across the core of the city. We have not seen anything like this since 2008. Even in 2008 and 2009, the prices in Back Bay never dipped below where they had plateaued in 2007.

For those who are thinking about a purchase, 2020 and 2021 are very likely to be historically great times to buy property even if we don’t see the increases that we’ve seen in the past decade from a pure investment perspective. Easier said than done but don’t try to catch that falling knife if you’re a buyer. Get out there and take advantage of those great interest rates if you are able! We think you will be happy that you did when you look back 5 to 10 years from now.

On the seller side, you may have to hold your nose. It’s going to be tricky to achieve what you could have achieved in 2018 or 2019 from a pricing perspective. Be reasonable with your expectations and you may be able to control some of the other deal terms (timing, inspections, financing, etc). Either way, the end of the year is closer than we realize and 2021 is likely to be better than 2020!