Well, we’re moving quickly(??) through our third week of social distancing and quarantine in the Boston area. I’m trying to remember what “normal” used to be while also trying to triangulate what normal can and will be. I’ve heard a reference to this timing potentially being “the eye of the storm” as it relates to our economic crisis. That resonates with me and I would not be surprised to see additional negative news coming from financial markets in the weeks and months to come. We’re being told by government officials that the worst of the pandemic is expected to set in during the middle of April: still two full weeks from now. In the Great Recession markets finally bottomed in March of 2009 after showing signs of life in the later fourth quarter of 2008. So, overall, I think it’s prudent to prepare for more negative news before things improve.

I’ve been dismayed to witness some in our industry carrying on with rhetoric that this abrupt and unprecedented pandemic will not materially impact what we’ve known to be true for at least a half a decade now in Boston… well priced homes sell fast! I believe this has and is continuing to change. That’s not to say homes will not sell… However, expectations are being reset every single day right now. Until we gain some additional “footing” with the financial markets I believe real estate liquidity will remain limited.

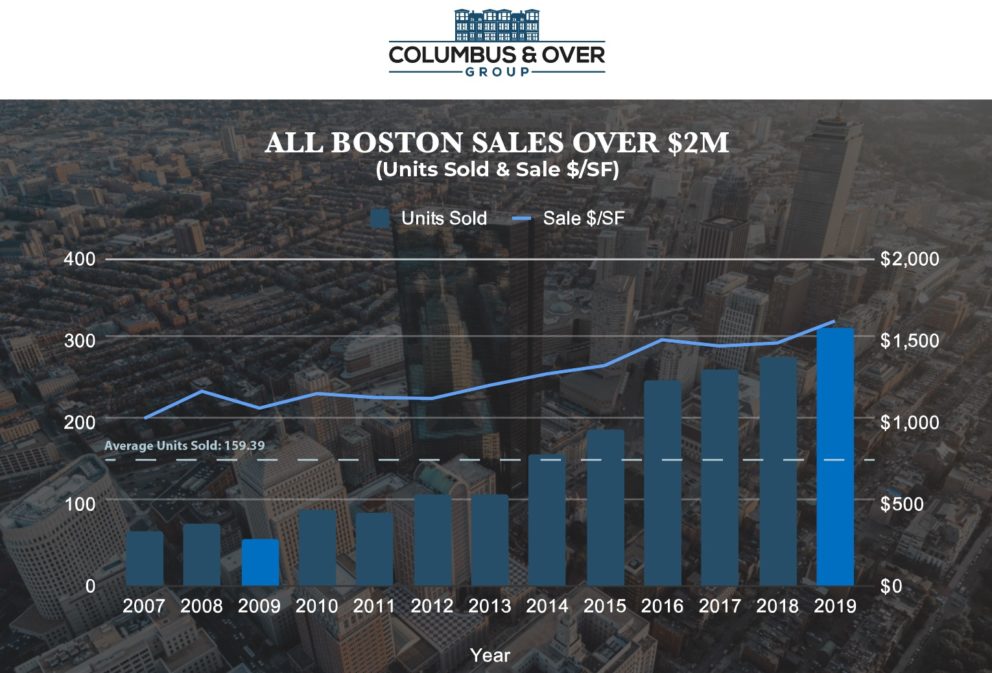

Outside of the basic health questions that we are all confronted with daily, foremost on my mind, and those of our clients, is what will happen to our Boston real estate market once we escape the quarantine phase? Looking backward, I don’t think it’s lost on anyone that we’ve had an incredible run.

2009: 59 condo sales with $1,077/SF avg | 2019: 315 condo sales with $1,621/SF avg

That is a 50% gain in pricing while looking at 5x the number of transactions in ten quick years! Looking at the market as a whole, Boston pricing (in terms of $/SF) AVERAGED 6.4% growth per year for a decade from 2009 through 2019. Put another way, if you purchased a $1M condo in 2009, it is likely worth more than $1.85M in early 2020. Taking it a step farther, if you put 20 percent down ($200,000) on that $1M purchase, you would have quadrupled your equity in a decade! Suffice it to say, I’m not sure we could find another decade that exploded quite like the last one did. And, I don’t think any of us should expect to find another decade like that in the foreseeable future.

Don’t get me wrong, real estate will remain a great and powerful asset class beyond this next cycle. One where your money can be preserved and grown. Additionally, there remain plenty of tax benefits to owning real estate that will not disappear anytime soon.

As we go through this downturn, it’s incredibly important to realize how fortunate we’ve been for those who have owned real estate in Boston. For those who have yet to own, 2020 and 2021 are very likely to be historically great times to buy property even if we don’t see the multiples that we’ve seen in the past decade from a pure investment perspective. So, get out there and take advantage of those great interest rates if you are able! We think you will be happy that you did when you look back 10 years from now.