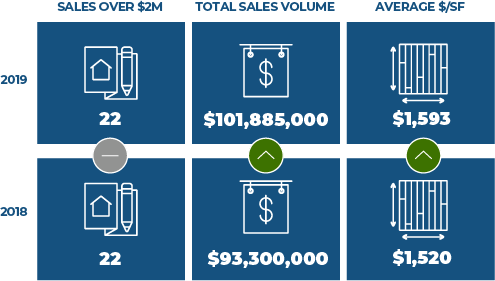

The first 5+ months of 2018 yielded 22 sales over $2M in Beacon Hill. Amazingly, through June 12, 2019, we have witnessed the exact same number of closed deals at the $2M+ mark. While the number of sales stayed even, the average price per square foot shot up nearly 5 percent to $1,593 (2019) versus $1,520 (2018). Heavy numbers, no doubt!

The two years have contributed $93.3M and $101.9M in volume over the period, for 2018 and 2019, respectively. Each of the first halves of the last two years saw one sale close for over $15M. 2019 has been slightly more “top heavy” than the previous year with 7 sales between $2 and $3M but nine sales hitting north of $4M. 2018 featured 12 sales between $2 and $3M with seven sales topping $4M by June 12.

Sold: 40 Beacon St, #3 | $15,750,000 | $3,119 / Sq. Ft.

Dialogue in the market continues to center around the prevalence of price drops we are seeing. This behavior persists due to sellers pushing asking prices higher and higher while buyers generally reject paying a premium against what their counterparts paid in the previous year and what sellers seem to expect today. Ultimately, we know that inaccurate pricing almost always costs sellers more than settling for what the market will pay immediately. A shortage of buyers is not our issue… but a shortage of discernible value is an issue. We should be clear, value at the super luxury end of the market does not seem to be a “thing.” Buyers have no trouble paying $2,500 to $3,000 per square foot for the trophy properties that have come online only in the past 2 to 3 years.

That sellers think their properties are worth more than what buyers infer is nothing new. But in a market with growing inventory, this can and will exacerbate a potential disconnect in the offer to asking price spread. With the all-new Archer development in Beacon Hill (45 Temple Street) among other smaller brownstone renovations, like the Victoria Residences on Bowdoin Street, there is likely to be increasing supply to choose from as we move deeper into the year and away from the always busy spring market. As of this writing, we’re seeing nearly 11 months of supply in Beacon Hill. As a reminder, 5-6 months of supply is a “balanced” market. Anything more is a buyer’s market.

Message to luxury real estate sellers: this is not the time to hold out for the last dollar!