It’s early September and Boston’s brokerage world is ramping up for what (we hope) will be a productive fall sales market. The summer months have come and gone with a rather flat state of affairs.

The item that stands out the most between the two years is the percentage of properties that are sold/under contract. In 2021, we saw 60% of properties trade. In 2022, that percentage currently stands at 35%. Certainly there’s additional time for properties to trade that came on the market this summer but it is feeling like a stretch to think this year’s sales figure will contribute an additional 40 sales particularly in light of incoming inventory in the fall market.

This is emblematic of a theme we felt in the summer of 2022… Save for a few select transactions, the market was generally “soft.” Summers always witness a slow down after the intensity of spring sales but this year, in particular, saw even more caution from buyers who lingered after early spring competition and languished with the rate hikes of the later spring and early summer.

Looking Ahead.

As we enter the second week of the fall market we’ve seen a welcome dose of new inventory with 58 new condo units on the market in the last 8 days alone. For comparison, in the last two weeks of August there were 18 new condo units on the market in this category ($1M+, BB, BH, SE).

There is an expectation that interest rates, after dropping back to slightly more tolerable levels during the slower summer months, will increase through the fall. The Fed is signaling that they will again hike their rate by 0.75% at September’s meeting (next week).

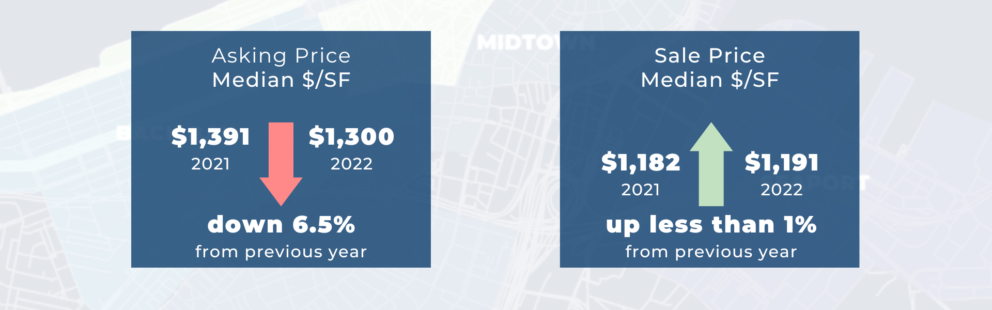

To summarize our expectations, we believe the fall will see increases in inventory versus what has been felt the last few months (and even against the fall of 2021). We also expect buyers to be more active in the early fall than they’ve been in several months as they come to terms with where “normal” is truly settling out in post pandemic times. Sellers, too, should be better acclimated to the market conditions, understanding that the peak conditions of early 2022 have more than likely passed us by. All that to say, we may find a balance of forces this fall leading to a shrinking of the “bid-ask” spread and a (modest) uptick in deal activity across the city. When the year closes out, we should see a rather flat year in terms of pricing (2021 vs 2022) which balances a robust first quarter, a slower second and third quarter and a balanced fourth quarter.

If you’re interested in engaging with the market in any capacity this season, please let us know so we can customize a plan for your unique needs.